SCHOLARSHIPS

& GRANTS

Nearly all Neumont students are awarded some sort of financial aid. 95% of Neumont freshmen received a Neumont grant or scholarship in 2024*. Financial aid is available for those who qualify.

When you apply for admission, you're automatically considered for scholarships; no separate application is required. To encourage the enrollment of highly qualified students, Neumont offers grants and scholarships based on academic merit, need, residency, and other factors.

Click here for more information about our scholarships and grants.

QUICK REFERENCE: important financial aid info

College is one of the most important decisions of your life – and we know that the college funding process can be daunting. That's why our Financial Aid Advisors are knowledgeable, friendly, and responsive. Their purpose at Neumont is to explain each step in the funding process, answer all your questions, and help you develop a personalized plan that works for you and your family. Financial aid is available for those who qualify.

NEUMONT’S FAFSA CODE:

009948

Contact Financial Aid:

Call: 866-801-1300

Email: financialaid@neumont.edu

Net Price Calculator:

TUITION & FEES

Scroll through the information below to find out more about how tuition and fees are charged at Neumont University. Housing, laptop costs, books, supplies, and other fees may be rolled into a student's final financial aid package. Tuition and fees are subject to change.

| FEE | DETAILS |

|---|---|

| TUITION |

$8,670 per quarter: |

| HOUSING |

$2,375 per quarter: |

| TECHNOLOGY PACKAGE |

$3,100 One-time cost (may be funded through a student's financial aid

package): |

| ACTIVITIES FEE |

$150 per quarter |

| TECHNOLOGY FEE |

$450 per quarter |

| TRANSPORTATION FEE |

$120 per quarter: |

| PROGRAM SPECIFIC FEES |

$25-$250 per quarter: |

Cost of Attendance

2025 - 2026 Academic Year

The Cost of Attendance (COA) is an estimate of school-related expenses that a student can expect to pay in one academic year. COA expenses include tuition and fees, books, supplies, course material and equipment, housing and food, transportation, and personal expenses. These components are determined in accordance with law, Higher Education Act of 1965, section 472, and are designed to cover the educational-related expenses of the student. COA also factors whether a student lives on campus, off campus, or off campus with a parent/relative.

On Campus

Direct Costs

Tuition & Fees = $28,095

Housing & Food = $15,183

Equipment = $3,100

inDirect Costs

Books, Course Materials, & Supplies = $1,200

Personal Expenses = $3,303

Transportation = $1,458

Total = $52,339

Off Campus

Direct Costs

Tuition & Fees = $28,095

Housing & Food = $10,512

Equipment = $3,100

inDirect Costs

Books, Course Material & Supplies = $1,200

Personal Expenses = $3,303

Transportation = $1,458

Total = $47,668

Off Campus (LIVING WITH Parent/Relative)

Direct Costs

Tuition & Fees = $28,095

Housing & Food = $5,265

Equipment = $3,100

inDirect Costs

Books, Course Material & Supplies = $1,200

Personal Expenses = $3,303

Transportation = $1,458

Total = $42,421

Students may access the Net Price Calculator to estimate financial aid and total cost of attendance.

All costs are subject to change without notice and are expected to increase annually. The Cost of Attendance is based on estimated figures and may not accurately reflect an individual students’ costs. The combination of the direct and indirect costs will be used to determine financial aid. Please note, this rate is based on reported average costs for all undergraduate students at Neumont University. Personal expenses include things like medical expenses, clothing, haircuts, telephone, and other utilities, etc. A student financial aid package may not exceed the students COA.

SCHOLARSHIPS, GRANTS,

& LOANS

We realize that paying for college is a major investment for most families. For that reason, we provide individual assistance through the Financial Aid Office to help students formulate a plan to finance their education. In addition to federal grants, you may qualify for one of many Neumont grants and scholarships.

| SCHOLARSHIP TYPE | Amount |

|---|---|

| PRESIDENTIAL |

Up to $8,670 per quarter: |

| ACHIEVEMENT | Up to $1,700 per quarter:

|

| ACCESS GRANT | Up to $500 per quarter: |

| SILICON SLOPES UTAH GRANT |

Up to $2,500 per quarter: |

| OUTSIDE SCHOLARSHIP MATCH | Up to $5,000 for the first academic year: |

| WOMEN IN TECHNOLOGY SCHOLARSHIP | Up to $1,000 per quarter: |

| TRANSFER SCHOLARSHIP | Up to $1,000 per quarter: |

| SERVICE SCHOLARSHIP | Up to $1,000 per quarter: |

| ALUMNI GRANT | Up to $1,000 per quarter: |

student loan options

After you've reduced your total cost of attendance with scholarships and grants, it's time to figure out how to cover the rest. Of course, you should first start with any savings, but if you still come up short, there are a variety of affordable federal and private loan options out there. These options are loans and must be repaid.

Federal Direct Subsidized Loan: Federal student loan for students with demonstrated financial need (based on the EFC on the FAFSA). Fixed interest is subsidized (paid for) by the U.S. Department of Education while the student is enrolled at least half-time (6 credits). Loan is not dependent on credit. Six-month repayment grace period after graduation.

Federal Direct Unsubsidized Loan: Same as a Federal Direct Subsidized Loan, except that financial need is not required and the student is responsible for paying the accrued interest after repayment begins.

Federal Direct PLUS Loan: Federal parent loans to help families pay for all college costs after grants and scholarships. Parent is responsible for accrued interest when repayment begins. Financial need is not required, but credit rating is a factor. Higher approval rates and lower interest than private loans. Allows for payment deferral up to six months after leaving school.

Private Student Loan: Private student loans require a co-signer. Financial need is not required, but credit rating is a factor. Several interest rate options are available, but rates are typically higher than PLUS loans. Some loan deferral options are available.

Neumont Institutional Loan Program: Neumont-funded student loan option reserved for students and their parents who are ineligible for PLUS and private student loans due to adverse credit and is serviced by an independent company called Tuition Options. Fund availability is limited.

FEDERAL GRANTS

Neumont participates in federal grant programs, such as Pell Grants and the Supplemental Education Opportunity Grants (SEOG). Students must show financial need, which is determined by the Estimated Family Contribution (EFC) on the Free Application for Federal Student Aid (FAFSA). Neumont also participates in educational programs for veterans. These options are grants and do not need to be repaid.

Federal Pell Grant: Grant that is evaluated annually based on the FAFSA, which must be submitted every year.

Federal SEOG: Supplemental Education Opportunity Grant is awarded to students with exceptional financial need, with priority given to Pell recipients. Limited funds awarded on first-come, first-served basis.

OTHER FUNDING OPTIONS

VA Education and Training Benefits: More information about education benefits offered by the VA is available at the official U.S. government website at WWW.BENEFITS.VA.GOV/GIBILL. GI Bill® is a registered trademark of the U.S. Department of Veterans Affairs (VA).

Yellow Ribbon Match: Grant that is partially or fully funded by the Veterans Administration and Neumont.

Professional Judgement

Sometimes, special or unusual circumstances not reflected on your Free Application for Federal Student Aid (FAFSA) can affect your ability to pay for your education. In these situations, federal regulations allow financial aid administrators to use professional judgment on a case by case basis, with documentation, to make adjustments to the data elements on your FAFSA that may impact your Expected Family Contribution (EFC). You may request an adjustment to the FAFSA data elements based on special or unusual circumstances. If you have a special or unusual circumstance and you would like to request a review, please reach out to your Financial Aid Advisor or email Financialaid@neumont.edu.

Special Circumstances refer to the financial situations that justify data elements to be adjusted. For example: Loss of job

Unusual circumstances refer to the conditions that justify an adjustment to a student’s dependency status based on a unique situation, more commonly referred to as dependency override. Examples that warrant an adjustment include but are not limited to: parental abandonment, human trafficking, refugee and asylee status, parent incarceration.

FINANCIAL AID Team

KYLee CHALK

Associate Director of Financial Aid

Kylee has worked in higher education for nine years, working seven of those years at Neumont. She assists all current students with reapplying for financial aid every subsequent academic. She hosts many financial aid workshops to educate students on the importance of their financial state as well as how to repay student loans. She works alongside Student Housing, Student Affairs, and the Registrar’s Office to assist in any student needs above and beyond financial aid.

education:

B.A. in Communications, Weber State University – Ogden, Utah

LESLIE TIPPETS

FINANCIAL AID ADVISOR

Leslie Tippets has been working in higher education for 10 years filling roles as an Admissions Supervisor, Director of Financial Aid and Compliance, and currently a Financial Aid Advisor. In her current position, Leslie’s responsibilities include financial aid counseling, packaging new students’ funding plans, providing financial aid counseling, and facilitating problem solving with students and their parents.

EDUCATION:

- Professional in Human Resources Certification, Salt Lake Community College – Salt Lake City, Utah

- Child Development Certification, Salt Lake Community College – Salt Lake City, Utah

MAUREEN RANKS

FINANCIAL AID ADVISOR

As a Financial Aid Advisor, Maureen works closely with incoming students and their families to help assess their financial aid needs and create a personalized funding plan for their Neumont education. Additionally, she assists current students to ensure their funding plan is on track throughout their duration here. Maureen brings to the role 13 years in higher education and her expertise in onboarding new students from her previous experience as an Admissions Officer with Neumont.

education:

AAB, Emphasis in Marketing, University of Phoenix – Phoenix, Arizona

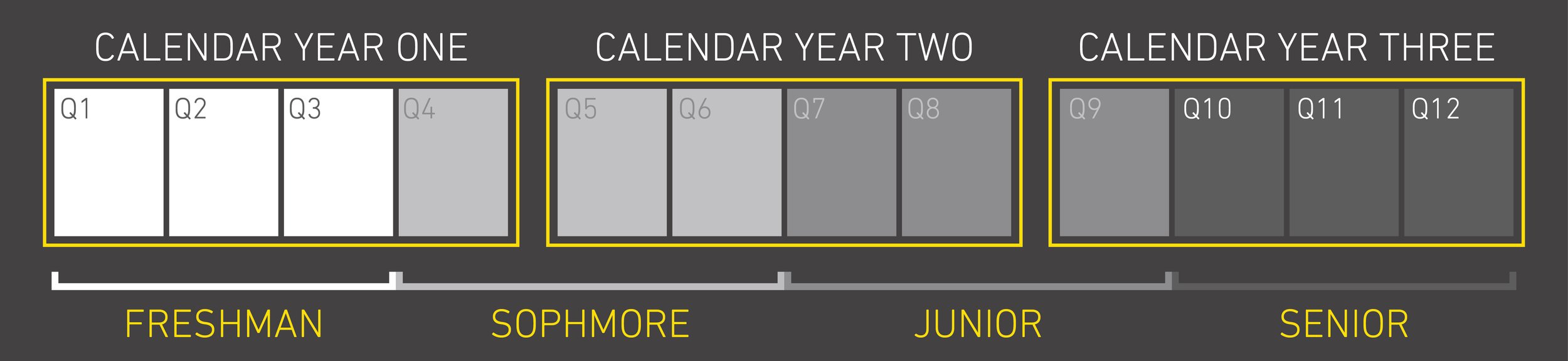

academic timeline

quarter SYSTEM BREAKDOWN

If you’re new to the quarter-system schedule, it can be a bit confusing. At Neumont, an academic year is nine months or three quarters in length. Check out the figure below to see how students can graduate in three calendar years.

FREQUENTLY

ASKED QUESTIONS

Loan Default Rate

Neumont is required to publish the institution’s loan default rate for federal loans. The current institutional default rate is 0.0%